Introduction

2022 was a record-breaking year for the Liquefied Natural Gas (“LNG”) industry with the Russian invasion of Ukraine in February setting in motion events that would lead to the highest and most volatile prices ever recorded. There were also fundamental changes in short-term trading patterns as Europe came into the market for approximately 50 million tonnes per annum (“Mtpa”) more LNG, creating head-to-head competition with Asia. Globally buyers reviewed their purchasing strategies and, particularly in Asia, a renewed focus on security of supply led to the signing of around 50 Mtpa more long-term contracts including the biggest and longest deal ever between Qatar Energy and the major Chinese buyer, Sinopec.

Although spot prices have receded significantly to pre-invasion levels, the market is still structurally tight and concerns remain that there are at least 2 more northern hemisphere winters where any prolonged cold weather will challenge the global LNG supply demand dynamics, before there is a prospect of a more balanced market.

This Martello Expert View explores how this was achieved and asks if the stresses seen in 2022 are still influencing markets and how recent events may trigger disputes in the LNG sector.

LNG in 2022 – A Record Breaking Year

Russia’s invasion of Ukraine had a huge impact on LNG markets in 2022. Practically overnight the dynamics of the industry changed as a market already short of supply was subjected to new stresses. European gas consumers were shaken out of their relatively comfortable existence as often opportunistic buyers of LNG and forced into a situation where they quickly needed to find alternative supplies for Russian gas. Europe’s consumption of Russian pipeline gas was around 155 billion cubic metres (“Bcm”) in 2021 but varied hugely from country to country with some nations being 100% reliant on Russian gas. In 2022 Russian pipeline gas sales to Europe fell to 54 Bcm.

As spot prices soared to record highs, buyers faced potential margin calls on their hedging books of up to 80% of the cargo values and found themselves needing parent company guarantees or loans to hedge future purchases. Overall, in 2022 the EU, plus UK, Norway and Turkey imported 122 Mtpa as buyers consistently bought more spot cargoes to meet demand and build up storage volumes ahead of winter. Eleven new regas terminals were sanctioned and several more are under active development. Demand side management was encouraged (for example encouraging residential consumers to turn down thermostats) and industrial demand fell with rising prices. All in all, European gas demand fell by about 13%.

Whilst such actions undoubtedly helped Europe to stay warm and keep the lights on it was probably the mild winter that had most impact on ensuring Europe was supplied with natural gas. As of mid-2023 some short-term calm seems to have returned to the LNG market. Naturally, concerns remain over security of supply, but the record prices have subsided, and headlines are less fearful than in 2022. But, has the LNG industry really adapted to the changes seen in 2022 or have a combination of external factors, most especially a mild winter in Europe and Asia given an impression of calm that is unjustified?

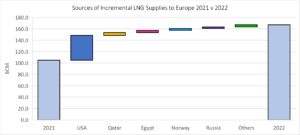

The European market remains structurally short of LNG. In 2022 USA supplied two-thirds of Europe’s incremental LNG imports and was key in backfilling the gap left by Russian gas supplies. Other producers such as Qatar, Egypt and Angola also stepped-up deliveries.

Europe’s increased need for LNG has taken cargoes away from Asian buyers some of whom have reverted to coal burning in the face of dwindling LNG supplies, whilst others have shelved plans for new LNG import infrastructure. As long as Asian buyers, particularly the price sensitive ones, have stepped out of the spot market, Europe has a good chance of securing the additional cargoes it requires to keep the market in balance. But for how long can Asian buyers curtail their LNG demand. Some have limited alternatives to LNG (for example Japan) whilst others, such as China, can physically rely on burning more coal for now, but will have to eventually adhere to government policies for natural gas consumption in coming years.

Energy transition in many countries has taken a back seat to security of supply due to record high prices in LNG but a key question is how long will this compromise be acceptable? Furthermore, non-OECD countries in Asia tend to see much higher growth rates for energy consumption than the mature economies of Europe. Thus, whilst they are price sensitive, they are also energy hungry and natural gas, and LNG, is very likely to feature in the future supply plans for many countries. If Asian demand awakens this will disrupt the current fragile balance in the LNG market.

New LNG Capacity

With the global market outlook for LNG remaining short and the record high prices of 2022, one could expect to see a rapid rush to Final Investment Decision (“FID”) for new liquefaction capacity. However, whilst approximately 28 Mtpa of LNG capacity reached FID in 2022 the market will require more to address the structural shortfall in LNG supply. Other projects seem to be struggling to reach the final hurdle of FID.

Naturally high LNG prices stimulate interest in new LNG projects but to sanction a project more than just high prices are required. Large scale LNG projects will typically require the following to be in place before reaching FID:

Whilst high prices can stimulate investment, many other factors need to be in place. Of course, prices weren’t just high in 2022, they were both high and volatile, which is a poor basis from which to negotiate long-term Sales and Purchase Agreements (“SPAs”). When you add the serious concerns that have been raised about TTF (the virtual trading point for gas in the Netherlands) being fit for purpose to trade LNG into Northwest Europe and the basis differentials between the TTF and NBP (the UK equivalent of TTF) then the difficulty of reaching agreement on pricing formulae within new contracts is very clear.

Outside of pricing and SPA issues, project developers also face challenges in rising construction costs and increases in the cost of capital, both of which can undermine the economics of LNG projects and make project financing more difficult. So, whilst 2022 proved an excellent year for those existing producers with spare capacity or divertible cargos it didn’t provide the best basis for future investment decisions.

LNG in 2023

How is the LNG industry positioned for potential future upheavals? Supply remains tight and the turmoil of 2022 was largely managed by reducing demand and by rising prices forcing a new distribution of spot LNG that could be diverted. As noted above, Asian consumers have reduced their gas usage and other markets have also seen reduced consumption. For example, German industrial consumption is considerably down and, here, fuel switching is not as easy as in some Asian market. Whilst German gas consumption is down (which is good for the global LNG balance) reduced industrial output has severe consequences for long term economic growth.

When, or perhaps if, global LNG prices moderate towards the $10/MMBtu we can expect to see a strong resurgence of Asian demand but, even if prices do not moderate, there will be environmental pressures to curb coal burning. Whilst the timing of a return of Asian demand is uncertain (and much depends on China’s gas policies) we can be fairly sure it will happen and, when this demand surges it will result in stiff competition with other regional markets.

Conclusions/Impact for the Legal Sector

Progressively throughout the 2020s and 2030s, the LNG industry needs additional supply capacity and, with this need there will of course be the need for long-term SPA’s to be negotiated. Some challenges in negotiating new long-term contracts in volatile times are noted above. However, these challenges are also applicable to the renegotiation of prices under price reopener clauses in existing SPA’s. Large amounts of capacity that came online in the period 2018/9 are approaching their first renegotiation option. Doubts about TTF viability as a pricing basis, and the fact that Asian gas hubs are still maturing, could well lead to disputes arising from failures to agree a new pricing basis.

As trading patterns have fundamentally changed, we may also see disputes arising from the interpretation of destination clauses, shipping obligations and other SPA provisions as producers seek flexibility to deliver their cargoes to the highest price markets while consumers seek to secure supply.

The pressure to build new liquefaction and regasification capacity quickly and as cheaply as possible, plus competition for experienced contractors and long lead items may well also lead to disputes over the execution of projects.

Overall, the LNG industry has, over many years, shown itself to be robust, adaptable, and responsive to changes in the markets it serves. Nevertheless, there are challenges ahead in order to keep markets supplied. As discussed in this Martello Expert View, the LNG market changed so much in 2022 that we used up a lot of the safety margin and options for flexibility. To Conclude, the industry simply does not have the ability to easily switch much more LNG consumption to other fuels and neither can we continue to rely on mild winters to ensure our supplies.